Industries

Flexible Loans for Warehouse & Wholesale Businesses

At SVP Funding Group, we provide personalized warehouse loans to businesses nationwide.

We're a Partner with a Proven Track Record

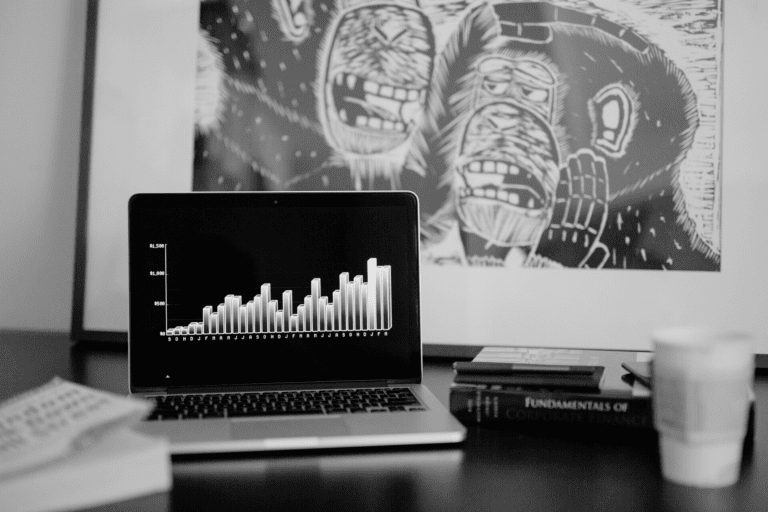

By the Numbers

With 12 years of combined experience, we’ve helped businesses grow.

Fast funding. Same-day approvals. No credit impact.

Apply online and get funded fast.

What Is Warehouse Funding?

Warehouse finance is a type of loan provided to businesses involved in storing and distributing products to other businesses. It offers the flexibility to build up inventory, respond to sudden changes in demand, and capitalize on growth opportunities as they emerge. With this funding in place, businesses can ensure they have the necessary stock available for retailers when it’s needed most.

How Funding Works for Warehouse Businesses

Warehouse businesses require financing for a range of operational needs. Due to fluctuating demand, access to funding is essential for covering day-to-day expenses, payroll, and inventory acquisition. Warehouse financing can also support investments in marketing, facility expansion, new equipment purchases, and other growth initiatives.

How To Use a Warehouse Loan

The use of a warehouse loan will vary based on your business requirements and the loan's conditions. Certain loans are ideal for purchasing equipment, while other credit lines assist with covering miscellaneous expenses and maintaining adequate product inventory.

Inventory

Warehouse businesses depend on having the correct inventory from suppliers to sell to retail stores. Warehouse funding guarantees that the business can acquire what it needs exactly when it is required.

Expansion

Expanding warehouse operations requires capital. You don’t want to use all your cash flow for these initiatives. That’s where obtaining funding for your warehouse business can be beneficial.

Equipment

Outdated or broken equipment can hold your business back. Secure the right equipment loan to assist in repairing or replacing your existing tools.

Why Apply for a Warehouse Loan?

Implement the Latest Technology

Whether it’s software or picking and packing tools, obtaining a loan to cover warehouse technology can elevate your business to the next level.

Invest in Marketing

Looking to reach the right buyers? Marketing can help your warehouse business achieve that. Take advantage of various lending options tailored specifically for warehouse companies.

Hire Talented Professionals

Hiring the right staff members is invaluable. Warehouse loans provide access to funds that can help you bring the right professionals into your business.

Minimum Eligibility Requirements

Time in Business

Minimum 1 Year

Business Annual Growth Revenue

No minimum

Business Checking Account

Yes

US Citizen/Based Company

Yes

FICO Score

500+

Other Funding

Subject to underwriting

Bankruptcies

None preferred

Warehouse Funding FAQ

The difference lies in who the funding is intended to support. Retail funding backs businesses that sell directly to consumers, while warehouse funding supports businesses that store and distribute goods to other entities. Lenders evaluate different criteria based on whether the business operates in retail or warehouse distribution.

Applying for warehouse financing is typically quick—completing an application can take as little as 30 minutes. After that, funding decisions are often made within 24 hours to a few weeks, depending on the lender and complexity of the application.

Yes, we provide warehouse financing tailored to small business needs. Contact our team to explore the various options available and find the best fit for your operation.

Warehouse financing enables you to expand operations, purchase inventory, or cover payroll—without straining other areas of your business. While interest rates and repayment terms may vary, the flexibility it offers can be a valuable tool for growth.

Most warehouse financing decisions are made within 24 to 72 hours. Some loans are even approved and funded within a single business day, depending on the lender and loan type.

Yes. Warehouse loans are often used to buy inventory in bulk, helping you take advantage of supplier discounts and stock up ahead of peak seasons.

In some cases, yes. Secured loans may require collateral such as inventory or business assets. However, unsecured options like business lines of credit are also available.

Absolutely. Warehouse loans can help cover cash flow gaps caused by delayed client payments or supplier disruptions—ensuring operations stay on track.

Yes. Inventory financing, business lines of credit, and invoice factoring are common options designed to meet the needs of warehouse distributors.

Yes. Warehouse financing can support expansion initiatives like leasing a larger facility, upgrading infrastructure, or implementing more efficient distribution systems.

Lenders typically evaluate your credit history, business financials, revenue trends, and ability to repay the loan. Strong inventory management and operational records can improve your chances.

Yes. Many businesses use warehouse funding to support e-commerce platforms, digital marketing, and expanded online sales operations.

If you personally guarantee the loan, lenders may check your credit. This could impact your score if payments are missed. However, consistent repayment can also help build business credit.

Yes, most lenders allow early repayment. However, some may charge prepayment fees—so it’s important to review your loan terms carefully.