The Economic Injury Disaster Loan (EIDL) program has been a vital source of financial assistance for small businesses affected by disasters, including the COVID-19 pandemic.

Understanding the EIDL loan interest rate is crucial for business owners to make informed financial decisions when considering this funding option.

This comprehensive guide will explore the EIDL interest rate structure, compare it to other loan options, and examine the factors influencing these rates and their impact on overall loan costs.

Key Takeaways

- The EIDL program provides financial assistance to small businesses affected by disasters.

- Understanding EIDL loan interest rates is essential for informed financial decisions.

- EIDL interest rates are fixed throughout the loan term, providing stability for business planning.

- The guide covers eligibility requirements, application processes, and repayment terms.

- Knowledge of EIDL loan terms helps businesses forecast cash flow and plan for recovery.

What Are EIDL Loans and Their Purpose?

EIDL loans are designed to provide relief to small businesses and non-profit organizations impacted by economic disruptions. The Economic Injury Disaster Loan program is a critical initiative by the Small Business Administration (SBA) to support businesses during challenging times.

Overview of the Economic Injury Disaster Loan Program

The EIDL program is administered by the SBA to provide financial assistance to businesses experiencing substantial economic injury due to declared disasters. This program is crucial for helping businesses meet their financial obligations and operating expenses.

History and Evolution of EIDL During COVID-19

Originally designed to aid recovery from natural disasters, the EIDL program was significantly expanded during the COVID-19 pandemic. The SBA increased maximum loan amounts from $500,000 to $2 million to accommodate more businesses and provide adequate capital for recovery efforts.

Key Features of EIDL Loans

EIDL loans offer a long-term, low-interest structure, making them a valuable funding source for businesses needing extended time to recover. These loans can be used for working capital, paying fixed debts, payroll, and other business expenses. However, funds cannot be used for business expansion or refinancing long-term debt.

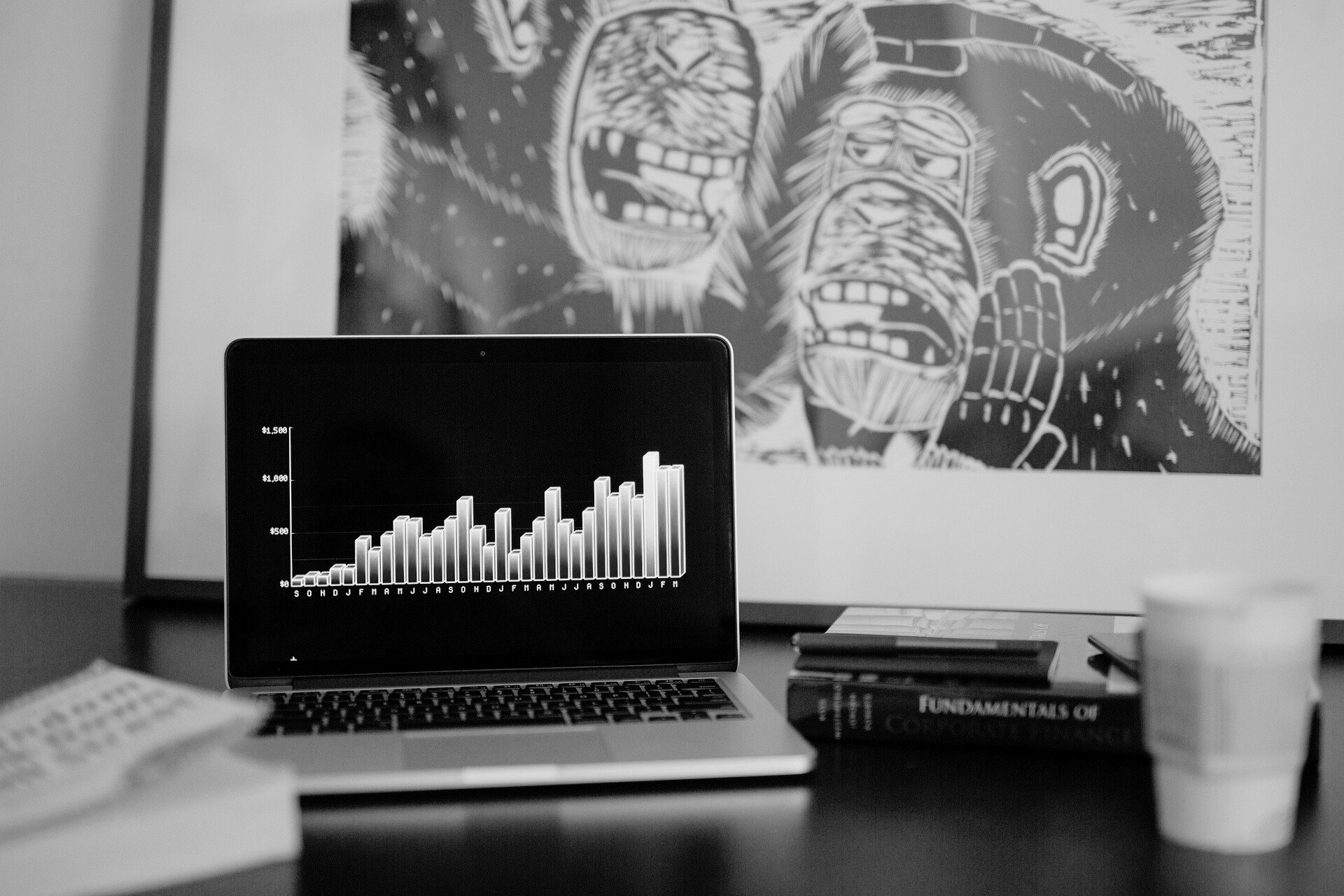

EIDL Loan Interest Rate Structure and Terms

The Small Business Administration’s (SBA) Economic Injury Disaster Loan (EIDL) program is a vital resource for businesses affected by disasters. EIDL loans, provided by the SBA, come with interest rates that vary based on the type of business entity, making it essential for businesses to understand these rates to navigate their financial obligations effectively.

Current Interest Rates for Businesses vs. Non-Profits

The current interest rates for EIDL loans are 3.75% for small businesses and 2.75% for non-profit organizations. This differentiation reflects the SBA’s mission to support various entities based on their operational structure and financial capabilities.

Maximum Loan Amounts and Term Lengths

EIDL loans offer generous terms, with maximum loan amounts reaching up to $2 million, based on the economic injury suffered. The repayment term can extend up to 30 years, depending on the business’s ability to repay the loan, making monthly payments more manageable.

How EIDL Interest Rates Compare to Other SBA Loans

Compared to other SBA loan programs like 7(a) or 504 loans, EIDL loans typically offer more favorable interest rates and longer repayment terms. This is because EIDL loans are specifically designed for disaster recovery rather than business expansion.

Factors That Influence EIDL Interest Rates

The SBA determines EIDL interest rates based on federal cost of funds, program administration expenses, and the need to maintain program sustainability. Notably, once approved, the interest rates for EIDL loans are not influenced by the borrower’s credit score, though creditworthiness affects initial eligibility and maximum loan amount determination.

Eligibility Requirements and Application Process

Businesses seeking EIDL loans need to understand the application process and eligibility criteria. The SBA has established specific requirements that businesses must meet to qualify for EIDL loans.

Business Size and Type Qualifications

To be eligible, a business must be a small business or a private non-profit organization. The SBA defines a small business as one with 500 or fewer employees. This includes sole proprietorships, independent contractors, and self-employed individuals. The business must have been in operation for at least one year before the disaster declaration.

Credit Score Requirements

The SBA has minimum credit score requirements for EIDL loan applicants. For loans up to $500,000, a credit score of 570 is required, while loans exceeding $500,000 require a credit score of 625 or higher. A good credit score enhances the likelihood of loan approval.

Economic Injury Documentation

Businesses must provide documentation to demonstrate economic injury due to the disaster. Required documents include tax returns, financial statements, and schedules of liabilities. These documents should clearly show how the disaster negatively impacted the business’s operations and cash flow.

Collateral and Personal Guarantee Requirements

For EIDL loans over $25,000, collateral is required, typically in the form of business assets. Additionally, for loans exceeding $200,000, personal guarantees from owners with 20% or more ownership are mandatory, making them personally liable for repayment if the business defaults.

| Eligibility Criteria | Requirement |

|---|---|

| Business Size | 500 or fewer employees |

| Credit Score (Loans up to $500,000) | 570 or higher |

| Credit Score (Loans over $500,000) | 625 or higher |

| Collateral Requirement | Required for loans over $25,000 |

| Personal Guarantee | Required for loans over $200,000 |

Understanding these eligibility requirements and preparing the necessary documentation can streamline the application process for EIDL loans, helping businesses recover from disasters more effectively.

Repayment Terms and Special Considerations

The repayment terms and special considerations for EIDL loans offer businesses flexibility and support during challenging times. The SBA has implemented measures to help businesses manage their loan obligations effectively.

EIDL loans feature generous repayment terms of up to 30 years, with payment amounts calculated based on the business’s financial situation and cash flow projections. For COVID-19 EIDL loans, the SBA extended the deferment period to 30 months from loan origination, allowing businesses substantial time to recover before beginning repayment.

Despite the payment deferment, interest continues to accrue during the deferral period, increasing the total loan amount due when regular payments begin. Businesses must carefully plan for this increased financial obligation. The SBA’s Hardship Accommodation Plan provides additional flexibility for struggling businesses, allowing them to make reduced payments for six months during times of financial difficulty.

It’s essential for businesses to understand that EIDL loans have no prepayment penalty, giving them the freedom to make additional payments or pay off the debt early without incurring extra costs. However, businesses must use EIDL funds only for approved operating expenses and working capital needs to avoid default and immediate repayment demands.

Businesses should maintain detailed records of how EIDL funds are used, as the SBA may conduct compliance reviews to ensure proper fund utilization. Additionally, tax considerations are important for EIDL borrowers, as interest payments are generally tax-deductible business expenses.