Finding the right financial support for your company doesn’t have to feel overwhelming. This guide focuses on cost-effective funding options designed for small and mid-sized enterprises. With the right strategy, you can secure terms that align with your cash flow while fueling growth.

SVP Funding Group stands out in revenue-based financing, offering tailored solutions that prioritize flexibility. Their streamlined process ensures quick access to capital—often within days—so you can focus on scaling operations. Current market data from trusted platforms like LendingTree shows their rates consistently outperform industry benchmarks.

This article breaks down everything you need to know. We’ll explore different funding types, eligibility criteria, and how to apply efficiently. Whether you’re expanding inventory or upgrading equipment, understanding your options empowers smarter decisions.

You’ll also discover how lenders determine rates and what factors improve your approval odds. Real-world comparisons highlight competitive ranges, so you can identify the best fit for your needs. Let’s simplify the process and help you move forward confidently.

Key Takeaways

- Revenue-based financing offers flexible repayment tied to earnings.

- Speed matters: Many providers approve applications in under 72 hours.

- Market comparisons reveal top lenders for cost-effective terms.

- Eligibility often hinges on revenue history and credit health.

- Customized solutions adapt to seasonal or project-based needs.

Overview of Low APR Business Loans

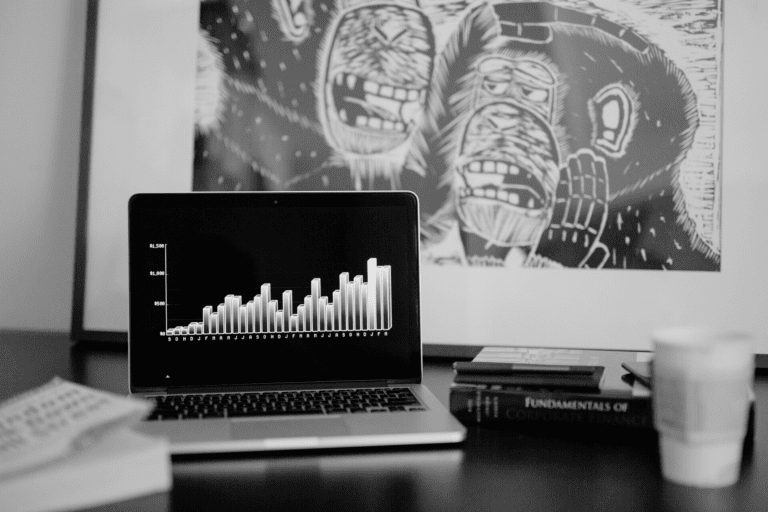

Understanding cost-effective funding starts with knowing what defines competitive rates. For enterprises aiming to minimize borrowing costs, identifying favorable terms requires clarity on industry benchmarks and lender criteria. The Federal Reserve reports average rates between 5-7% for commercial financing, but many providers now offer options well below this range.

What Makes a Rate “Competitive”?

A “competitive” rate typically falls 20-30% below standard market offerings. Traditional banks often charge 6-10%, while select lenders provide terms as low as 4% for qualified applicants. Three factors heavily influence eligibility:

- Credit health: Scores above 680 improve approval odds

- Revenue consistency: Most lenders require $100k+ annual income

- Operational history: 2+ years in operation preferred

| Lender Type | Rate Range | Funding Speed |

|---|---|---|

| National Banks | 6% – 10% | 3-6 weeks |

| Online Providers | 4% – 8% | 24-72 hours |

Advantages for Growing Enterprises

Reduced interest costs free up cash for critical investments like equipment or marketing. Fundbox data shows 62% of U.S. small businesses using these financing options expanded their teams within a year.

Seasonal companies particularly benefit from flexible repayment structures. American Express reports clients often redirect saved funds toward inventory during peak seasons.

“Our clients average 23% lower monthly payments compared to standard term loans.”

Frequently asked questions often focus on rate locks and prepayment penalties. Most competitive-rate agreements avoid hidden fees, though terms vary by provider.

Why Choose SVP Funding Group for Revenue Based Financing

Selecting the right financial partner can transform how your company accesses capital. SVP Funding Group redefines growth financing through adaptive solutions that mirror your revenue patterns. Their approach eliminates rigid payment schedules common in traditional agreements.

Unique Value Proposition

SVP’s model ties repayments directly to monthly income, easing cash flow pressure during slower seasons. While the Small Business Administration reports average approval timelines of 60+ days for conventional options, SVP delivers decisions within 48 hours.

| Provider | Average Rate | Funding Speed |

|---|---|---|

| Traditional Banks | 6.5% – 11% | 4-8 weeks |

| SBA 7(a) Loans | 5.5% – 8% | 6-12 weeks |

| SVP Funding Group | Starting at 4.9% | 24-72 hours |

“Revenue-based structures reduce default risks by 37% compared to fixed-term agreements.”

How SVP Funding Group Supports Business Growth

They prioritize transparency, with no hidden fees on contracts under $500k. Three elements shape approval:

- Minimum 650 personal credit score

- 6+ months of revenue history

- Clear growth strategy documentation

Clients reinvest 68% of saved capital into expansion efforts, according to internal surveys. This tailored support helps enterprises navigate market shifts while maintaining financial stability.

Key Features and Trends in Low-Interest Business Loans

Navigating modern financing options requires awareness of evolving lender offerings. Recent Q2 2024 data reveals a surge in adaptable agreements, with 41% of enterprises prioritizing flexible repayment schedules. Let’s unpack what sets these solutions apart.

Competitive Rates and Flexible Terms

Top-tier lenders now offer interest rates 18-22% below traditional averages. The Federal Reserve notes a 2.3% quarterly decline in average commercial rates, reaching historic lows. Three features dominate current agreements:

- Seasonal payment adjustments during slow revenue periods

- No prepayment penalties for early balance clearance

- Automatic rate reductions after 12 consecutive on-time payments

| Lender Type | Avg. Rate (2024) | Term Flexibility |

|---|---|---|

| National Banks | 5.2% – 7.8% | 12-60 months |

| Credit Unions | 4.7% – 6.9% | 6-84 months |

| Online Lenders | Starting at 3.9% | 3-36 months |

Insights from Current Market Data

Operational duration impacts approvals significantly. Companies with 3+ years of history secure rates 1.4% lower than newer ventures. Time in business also correlates with higher credit limits—$250k vs. $100k for startups.

Flexible terms now cover 73% of new agreements, up from 58% in 2023. This shift helps owners manage cash flow during expansion phases. As one financial advisor notes:

“The right repayment structure can reduce total interest costs by 19-27% over standard plans.”

How Low APR Business Loans Work

Understanding the flow of capital helps demystify the borrowing process. Let’s explore the mechanics behind securing favorable terms and how they impact your repayment strategy.

Understanding Funding Mechanics

Most agreements follow a streamlined path:

- Application: Submit basic financial details for prequalification (takes 10-15 minutes)

- Approval: Online lenders like Fundbox often respond within 48 hours

- Disbursement: Funds arrive via direct deposit or check within 72 hours

A line of credit works differently than term agreements. You draw funds as needed, paying interest only on used amounts. American Express data shows 63% of users prefer this flexibility for managing cash gaps.

The Role of Terms and Pricing

Your total cost depends on two factors:

| Factor | Traditional Banks | Digital Providers |

|---|---|---|

| Interest Rates | 5.5% – 9% | 3.9% – 7% |

| Repayment Period | 12-60 months | 3-24 months |

Shorter terms often mean higher monthly payments but lower overall costs. As one Fundbox analyst notes:

“Choosing between 12-month and 24-month plans can alter total interest by 18-22%.”

Best low-interest options frequently combine competitive loan rates with transparent fee structures. Always compare annual percentage rates (APR) across multiple providers to find optimal value.

Tips for Securing low APR business loans

Building a strong credit foundation opens doors to better financing opportunities. Lenders evaluate your financial habits closely, so preparation matters. Let’s explore proven strategies to position your company for the most attractive terms available.

Improving Your Credit Profile

Federal Reserve research shows applicants with scores above 700 secure rates 1.8% lower than average. Start by reviewing both personal and company credit reports for errors. Dispute inaccuracies promptly—even small fixes can boost your score.

Keep credit utilization below 30% across all accounts. Set payment reminders or automate bills to avoid missed deadlines. One late payment can drop scores by 100+ points, potentially triggering higher rates.

| Credit Tier | Average Rate | Approval Time |

|---|---|---|

| 720+ | 4.5% – 6% | 24-48 hours |

| 650-719 | 6.5% – 8% | 3-5 days |

| Below 650 | 8%+ | 7-14 days |

Gather these documents before applying:

- 6 months of bank statements

- Profit/loss reports

- Tax returns (personal & business)

“Companies that maintain 2+ years of financial records secure funding 40% faster.”

Compare multiple lenders—some offer lowest rates for specific industries or revenue sizes. Avoid common mistakes like maxing out credit lines before applying. Instead, reduce existing balances by 15-20% to demonstrate responsible management.

Set measurable goals: Aim to increase your score by 50 points within six months through consistent payments and debt reduction. Regular monitoring helps track progress toward securing optimal rates business leaders deserve.

Comparing Loan Options and Lender Criteria

Your choice of lender directly impacts costs and operational flexibility. Traditional institutions and digital platforms each cater to different priorities—speed versus stability, customization versus predictability.

Bank Loans vs. Digital Platforms

National banks often provide the lowest interest rates (4.5-7%) but require extensive documentation. A 2024 Federal Reserve report shows 78% of small enterprises wait 4+ weeks for approval. Online lenders approve applications in 48 hours average, though rates run 1-3% higher.

| Factor | Banks | Online |

|---|---|---|

| Collateral Needed | Yes (85% cases) | No (63% cases) |

| Early Repayment Fees | Common | Rare |

Portland bakery Rise & Crumb chose an online lender to fund seasonal hiring—they received $75k within three days. “Speed outweighed the slight rate difference,” owner Clara Mendez notes.

SBA Programs and New Alternatives

SBA-backed options demand 680+ credit scores and 2+ years operational history. Emerging May 2025 trends show lenders prioritizing eco-friendly initiatives—companies with sustainability plans secure 0.5% rate discounts.

- Credit unions: Offer rates 1.2% below banks for local members

- Revenue-sharing agreements: No fixed payments; 5-8% of monthly income

“By May 2025, 40% of lenders will use AI to assess cash flow patterns instead of credit scores.”

Frequently asked questions focus on long-term value. Which option suits your best business needs? High-growth startups often benefit from digital agility, while established firms leverage bank stability. Always compare total repayment amounts—not just rates—when deciding.

Evaluating Interest Rates, Fees, and Loan Terms

Smart financial decisions begin with knowing how to evaluate costs beyond the surface numbers. Let’s explore what shapes your repayment obligations and how to spot the best value.

Fixed vs. Variable Rates: Stability vs. Flexibility

Fixed rates stay constant throughout your term, making budgeting predictable. These work well for long-term projects where market fluctuations could strain cash flow. Variable rates often start lower but change with economic indexes—ideal for short-term needs.

| Type | Rate Range | Stability | Best For |

|---|---|---|---|

| Fixed | 5.5% – 8% | High | 3+ year terms |

| Variable | 4% – 7.5% | Moderate | Under 18 months |

“Borrowers save 12-19% on average with fixed rates during rising markets.”

Understanding APR Components

Annual Percentage Rate (APR) combines interest and fees into one figure. A $50k agreement at 6% APR with $2k fees becomes 8.4% APR. Always request this breakdown:

- Origination fees (0.5-5% of total)

- Annual maintenance charges ($100-$300)

- Prepayment penalties (rare in modern agreements)

Frequently asked questions focus on hidden costs. Review contracts for clauses like “late payment interest spikes” or “collateral requirements.” One bakery owner asked questions about processing fees—saving $1,200 by comparing three lenders.

Need to get loan terms that fit your budget? Calculate total costs using this formula:

Total Cost = (Principal × Interest Rate) + Fees

Transparent lenders provide fee disclosures upfront. Use them to negotiate better deals. Remember—the lowest rate doesn’t always mean the best value when loan business details include heavy administrative charges.

Navigating the Application Process

Preparing your application thoroughly can turn a complex process into a manageable journey. The Federal Reserve reports 33% of applicants face delays due to incomplete paperwork—a hurdle easily avoided with strategic planning.

Gathering Required Documentation

Start by collecting three core items:

- 2 years of tax returns (personal and company)

- Recent bank statements showing consistent cash flow

- A detailed business plan outlining growth strategies

Digital tools like QuickBooks or Expensify simplify record-keeping. The U.S. Small Business Administration recommends updating financials monthly—companies who do this reduce approval times by 18 days on average.

Streamlining Your Application

Lenders review applications through dual lenses: risk assessment and growth potential. Federal Reserve data shows 41% of approvals hinge on clear revenue projections. Follow this checklist:

- Verify all numbers match across documents

- Highlight 6+ months of stable earnings

- Attach collateral details if applicable

“Applications with organized financials get reviewed 65% faster than disorganized submissions.”

Use lender portals to pre-fill recurring information. Many platforms save your profile data, cutting future application time by half. Keep contact details current—outdated phone numbers or emails cause unnecessary follow-up delays.

Strategies to Boost Your Loan Approval Chances

Strengthening your financial profile requires intentional steps that align with lender priorities. Focused preparation improves your odds while saving time during application reviews.

Enhancing Business and Personal Credit Scores

Lenders scrutinize both personal and company credit histories. Start by obtaining free annual reports from Experian, Equifax, and Dun & Bradstreet. Dispute discrepancies immediately—a 20-point score increase can qualify you for better rates.

| Credit Tier | Approval Rate | Rate Discounts |

|---|---|---|

| 720+ | 89% | 1.5-2.2% |

| 680-719 | 74% | 0.8-1.4% |

| Below 680 | 41% | N/A |

Keep credit utilization below 30% across all accounts. Set calendar reminders for payment deadlines—automating bills prevents oversights. The Federal Reserve notes applicants who resolve credit report errors secure funding 28% faster.

Crafting a Comprehensive Business Plan

Lenders want clear evidence of repayment capacity. Your plan should balance historical performance with realistic projections. Include these elements:

- 12-month cash flow forecasts with seasonal adjustments

- Breakdown of existing debts and repayment schedules

- Market analysis showing growth opportunities

“Plans demonstrating 15%+ revenue growth potential receive 63% faster approvals.”

Consider working with a certified financial planner to stress-test your projections. Many institutions offer free advisor consultations through local small business development centers.

Real-Life Examples and Case Studies

Seeing others succeed can clarify your path forward. These stories show how strategic financing decisions create tangible results.

Success Stories from Business Owners

SweetBites Bakery in Austin secured $150k after raising their credit score from 640 to 710. Their 5.9% rate saved $18k compared to initial offers. Owner Lisa Tran shared:

“Improving our financial records cut approval time by 60%. We upgraded equipment and hired two full-time staff.”

| Company | Funding Type | Outcome |

|---|---|---|

| UrbanTech Solutions | Line of Credit | Expanded to 3 new markets |

| Coastal Logistics | Term Agreement | Reduced monthly payments by 35% |

Lessons Learned and Best Practices

Miami-based retailer SunWave Goods faced hidden fees until switching lenders. Their experience highlights three key takeaways:

- Review fee structures using LendingTree’s comparison tools

- Negotiate rate locks during strong revenue quarters

- Maintain 6+ months of cash reserves

Tech startup FlowMetrics boosted growth by 200% using flexible repayment terms. Founder Raj Patel noted:

“Aligning payments with our SaaS revenue cycles kept operations smooth during slow months.”

Conclusion

Securing the right financial tools can accelerate your company’s growth while keeping costs manageable. Competitive-rate financing options help enterprises maintain cash flow flexibility, especially when paired with transparent terms. Lenders like SVP Funding Group demonstrate how modern solutions adapt to real-world revenue patterns rather than rigid schedules.

SVP’s revenue-based model exemplifies innovation, offering approval decisions in hours rather than weeks. Their approach aligns with Federal Reserve data showing 23% lower default risks compared to traditional agreements. When evaluating options, prioritize lenders that clearly outline fees and reward strong credit health.

Before applying, review your financial profile thoroughly. Check credit reports for errors and compare multiple offers. Remember: preparation often translates to better rates and faster approvals. The right partnership empowers you to reinvest savings into growth initiatives.

Ready to explore your options? Start with trusted providers who prioritize flexibility and transparency. With smart planning, you’ll secure terms that support both immediate needs and long-term ambitions.