The SBA504 loan program is a vital financing option for small businesses in the United States, enabling them to acquire commercial real estate, equipment, and refinance existing loans. Fixed-rate financing is a key benefit, providing stability and predictability for business planning.

As of now, the latest interest rates for SBA504 loans are: 6.43% for a 25-year fixed rate, 6.45% for a 20-year fixed rate, and 6.34% for a 10-year fixed rate. For refinancing, there’s an additional premium of +0.025%. Understanding these rates is crucial in the current economic climate, as they significantly impact the total cost of the loan.

This article will delve into the SBA504 loan program, covering eligibility requirements, application processes, and benefits. Readers will gain insights into how these loans can support their business growth and financial stability.

Key Takeaways

- Current SBA504 loan interest rates for various loan terms.

- The significance of fixed-rate financing for business planning.

- Refinancing options and their associated premiums.

- Eligibility requirements and application processes for SBA504 loans.

- Benefits of utilizing SBA504 loans for business growth.

Understanding SBA 504 Loans

The SBA504 loan program is a vital financing tool for small businesses, offering a unique structure that combines funding from multiple sources. SBA504 loans are designed to support business growth through the acquisition of commercial real estate, equipment purchases, and refinancing existing debt.

The program operates on a zero-subsidy basis, meaning it doesn’t rely on taxpayer dollars. Instead, it uses 100% SBA-guaranteed debentures, backed by the full faith and credit of the United States, which are sold to investors monthly.

A key feature of SBA504 loans is their three-party structure, involving the SBA, a Certified Development Company (CDC), and a conventional lender. Typically, the loan structure consists of 50% from a conventional lender, 40% from the CDC/SBA, and 10% from the borrower.

These loans differ from other SBA programs, such as 7(a) loans, in their long-term, fixed-rate nature, providing a significant advantage for small businesses by offering stable, predictable payments.

Current SBA 504 Interest Rates Overview

Understanding the current SBA504 interest rates is crucial for businesses seeking optimal financing solutions. As of April 2025, the rates are competitive, offering various term options.

25-Year Fixed Rate Options

The 25-year fixed rate is currently at 6.43%. This longer-term option is advantageous for businesses looking to finance major assets with stable, long-term payments.

20-Year Fixed Rate Options

The 20-year fixed rate stands at 6.45%. Although slightly higher than the 25-year rate, it offers a balance between a reasonable term and manageable payments.

10-Year Fixed Rate Options

For businesses seeking shorter-term financing, the 10-year fixed rate is 6.34%. This option is ideal for assets with a shorter useful life, providing a lower rate and quicker payoff.

The SBA504 interest rates provide certainty for business planning, unlike variable rate alternatives. The next rate adjustment is scheduled for May 8, 2025.

How SBA 504 Interest Rates Are Determined

Understanding how SBA504 interest rates are determined is crucial for businesses considering this loan option. The effective interest rate on the SBA portion of a 504 loan is not determined until the debenture has been sold.

Relationship to Treasury Bonds

The SBA504 interest rates are typically reflective of 10-year U.S. Treasury bond rates. Historically, SBA504 rates and the 10-Year Treasury have followed a similar track. This relationship is due to the monthly debenture sales process, where the interest rates are influenced by current market conditions, particularly the yields on 10-year Treasury bonds.

Fee Structure Impact on Rates

The effective interest rate for an 504 loan includes not just the principal and interest but also various fees. These fees include CDC servicing fees, SBA guaranty fees, and central servicing agent fees. The fee structure for any given fiscal year, such as 2025, directly impacts the final rate borrowers receive, making it essential to understand these components when evaluating loan rates.

The “spread” between Treasury rates and final SBA504 rates is influenced by several factors, including the fee structure and market conditions. The “full faith and credit” backing of the U.S. government enhances investor demand, which in turn affects the resulting interest rates. Additionally, the zero-subsidy nature of the SBA504 program means that the program is designed to be self-sustaining, which influences rate determination.

SBA 504 Loan Rate History and Trends

Understanding the historical trends of SBA504 interest rates is crucial for businesses looking to secure financing or refinance existing loans. The SBA504 loan program has seen significant fluctuations in interest rates from 2020 to 2025.

Five-Year Rate Analysis

Over the past five years, SBA504 interest rates have experienced considerable volatility. Rates were at historic lows around 2.5% in 2020-2021 but have risen to over 6% in recent times. This change reflects broader economic trends and shifts in monetary policy.

- Rates for 25-year fixed options have seen significant increases, moving from lows of around 2.5% to current rates above 6%.

- The 20-year and 10-year fixed rate options have followed similar trends, with rates increasing substantially over the five-year period.

Quarterly Rate Movements

Analyzing quarterly rate movements reveals patterns and seasonal trends in SBA504 pricing. For instance, rates have shown variability across different quarters, influenced by economic indicators and Treasury bond yields.

- During the Jan-Feb-Mar quarter of 2020, rates were at their lowest, around 2.5%.

- In contrast, the Jun-Jul-Aug quarter of 2022 saw rates rise significantly, reflecting changes in economic conditions.

- Refinance rate premiums have also changed, from +0.0015% to the current +0.025%, impacting the cost of refinancing SBA504 loans.

By examining these trends and understanding the factors that influence SBA504 interest rates, businesses can make more informed decisions about their financing options.

SBA 504 Refinancing Options

The SBA504 refinancing program offers businesses a strategic financial tool to restructure existing commercial debt. This program allows businesses to refinance their current loans, potentially lowering monthly payments and improving cash flow.

Debt Refinancing Benefits

Refinancing through the SBA504 program provides several benefits, including the potential for cash-out options to cover business expenses. Businesses can also extend their loan terms, reducing monthly payments. Moreover, refinancing can help lock in long-term fixed rates, especially beneficial for those currently on variable rate loans.

Refinance Rate Premiums

The current refinance rate premium for SBA504 loans is +0.025%, making the refinance rates approximately 3 basis points higher than debenture pricing. Understanding this premium is crucial as it affects the total cost of the loan compared to standard SBA504 loans.

Key aspects of the SBA504 refinancing program include:

- Refinancing existing commercial debt to potentially lower monthly payments.

- A current refinance rate premium of +0.025%, slightly increasing the total cost.

- Eligibility requirements, including debt seasoning requirements, which businesses must meet.

- The opportunity to lock in long-term fixed rates, providing financial stability.

- Potential cash-out options for covering business expenses.

- Detailed documentation requirements specific to refinancing applications.

Businesses should carefully evaluate when refinancing makes financial sense and consider factors such as current interest rates, loan terms, and their financial situation. For some, refinancing through the SBA504 program can be a strategic move towards financial optimization.

Commercial Real Estate Financing with SBA 504

Commercial real estate financing with SBA504 loans offers businesses a robust solution for property acquisitions. This financing option is particularly beneficial for businesses looking to expand their operations or invest in new properties.

Property Types Eligible for Financing

SBA504 loans can finance various types of commercial properties, including owner-occupied commercial buildings, medical facilities, and industrial properties. The program is designed to support businesses in acquiring properties that meet specific occupancy requirements.

Loan Structure for Real Estate Purchases

The SBA504 loan structure for real estate purchases typically involves a combination of funding sources: a third-party lender provides up to 50% of the total project cost, an SBA504 loan covers up to 40%, and the borrower contributes at least 10% as a down payment. This structure allows businesses to conserve capital while investing in real estate.

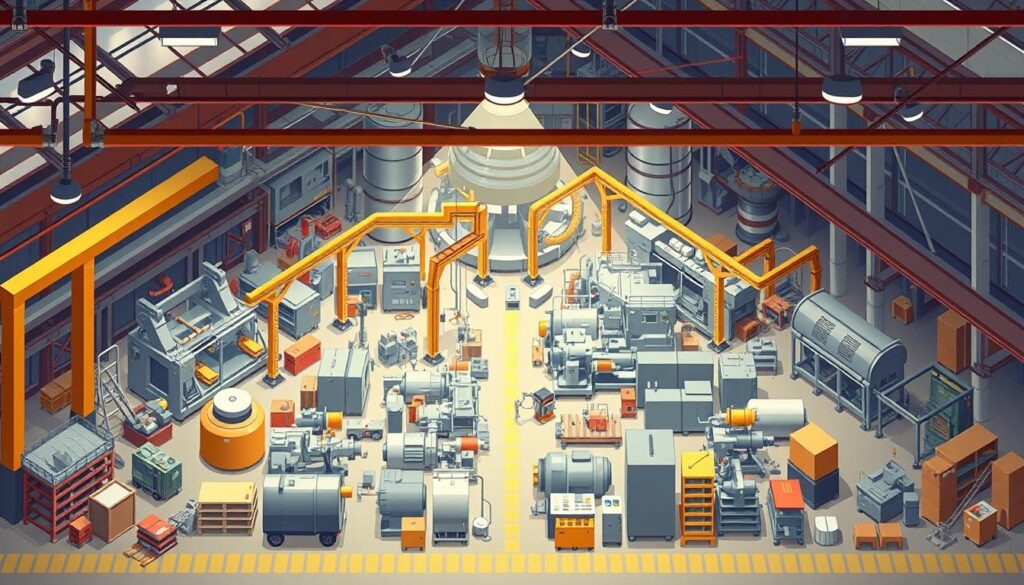

Equipment Financing Through SBA 504

The SBA504 loan program offers a versatile financing solution for businesses looking to acquire major equipment and fixed assets. This financing option is particularly beneficial for companies seeking to upgrade their equipment or expand their operations.

Eligible Equipment Types

The SBA504 loan can be used to finance a wide range of equipment types, including manufacturing equipment, medical equipment, and heavy machinery. This flexibility makes it an attractive option for businesses across various industries.

Term Length Options

The term length for equipment financing through SBA504 typically spans 10 years, although it can vary based on the equipment’s useful life. This alignment ensures that the loan repayment schedule matches the asset’s depreciation, providing a more manageable financial burden for businesses.

By opting for a fixed-rate SBA504 loan, businesses can avoid the risks associated with variable-rate loans or leasing agreements, securing a stable financial foundation for their operations.

Eligibility Requirements for SBA 504 Loans

Eligibility for SBA504 loans is determined by several key factors. Businesses must meet specific criteria to qualify for this financing option.

Business Size and Type Requirements

The SBA504 loan program is designed for small businesses, as defined by the SBA’s size standards. Typically, this means businesses with a tangible net worth not exceeding $15 million and an average net income after taxes not exceeding $5 million for the preceding two years. Eligible businesses include those involved in commercial real estate and equipment financing. Certain businesses, such as non-profit organizations and gambling businesses, are ineligible.

Financial Criteria for Approval

Lenders evaluate several financial criteria when considering SBA504 loan applications, including debt service coverage ratios and credit scores. Businesses are typically required to create or retain one job per $75,000 of SBA funding. The owner injection requirement is usually around 10%, and occupancy requirements for real estate projects are typically 51% for existing buildings.

The SBA504 loan program operates as zero-subsidy, meaning no taxpayer dollars are appropriated to fund these 504 loans. This makes it an attractive option for businesses seeking financing without burdening taxpayers.

The SBA 504 Loan Application Process

The SBA504 loan application process is a multi-step procedure that requires careful preparation. Businesses must understand the various stages involved, from initial inquiry to funding. The process typically involves working with a Certified Development Company (CDC), which plays a crucial role in facilitating the SBA504 loan.

Required Documentation

To apply for an 504 loan, businesses must gather and submit several key documents. These include business financial statements, tax returns for the previous mar apr may or sep oct nov periods, and projections for future growth. Ensuring that these documents are accurate and comprehensive is crucial for a successful application during the oct nov dec review cycle.

Timeline Expectations

The timeline for an SBA504 loan application process can vary, but it typically ranges from 45 to 90 days, covering periods such as aug sep or apr may. Understanding the different stages of review, including CDC, SBA, and conventional lender reviews, can help businesses plan and prepare accordingly, especially during peak review periods like nov dec.

Benefits of SBA 504 Loans for Small Businesses

By leveraging the SBA504 loan program, small businesses can access financing options that are tailored to their specific needs. The SBA504 loan program operates as a zero-subsidy program, with 100% SBA-guaranteed debentures backed by the full faith and credit of the United States.

Low Down Payment Advantages

The SBA504 loan program offers a significant advantage with its low down payment requirement, typically around 10%. This preserves working capital for business operations, allowing small businesses to allocate funds more efficiently. With a lower down payment, businesses can retain more capital for other essential expenses.

Fixed Rate Protection

The SBA504 loan program provides fixed-rate protection, shielding businesses from interest rate increases over the loan term. This feature is particularly beneficial in a rising interest rate environment, as it ensures that businesses can maintain predictable monthly payments. With a fixed interest rate, small businesses can better manage their finances and make more accurate forecasts.

Conclusion: Is an SBA 504 Loan Right for Your Business?

SBA504 loans offer a unique financing solution for small businesses, and assessing their fit for your company is vital. Throughout this article, we’ve explored the intricacies of SBA504 loans, including their current interest rates, loan options, and eligibility requirements.

To determine if an SBA504 loan is right for your business, consider your long-term growth plans and working capital needs. With the current interest rate environment in mind, evaluate how an SBA504 loan can support your business goals. For further assistance, contact a Non-Profit Organization Focused Exclusively on Small Businesses at 877-BEST504 or visit www.GrowthCorp.com.

By understanding the benefits and total cost of an SBA504 loan compared to other financing options, you can make an informed decision. Working with experienced SBA lenders is crucial to navigate the application process successfully.