Every growing company needs the right financial tools to thrive. Tailored financing options empower entrepreneurs to expand operations, hire teams, or upgrade equipment without draining cash reserves. For small to medium-sized ventures, choosing flexible funding can mean the difference between stagnation and sustainable growth.

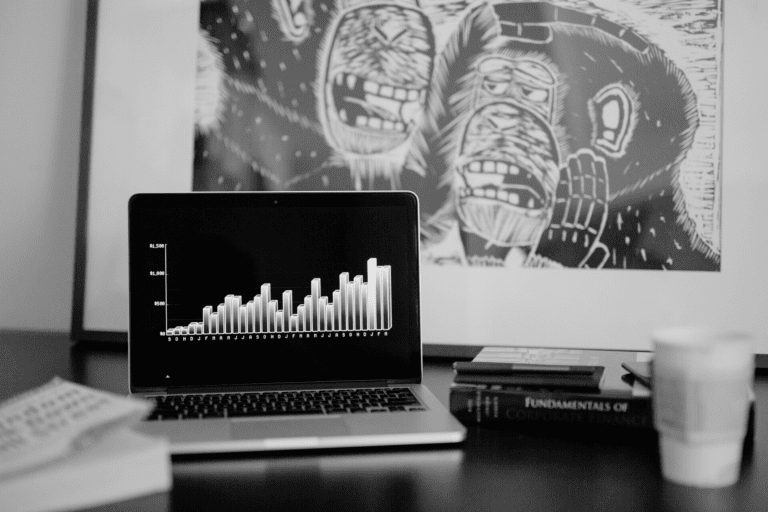

In today’s fast-paced economy, access to capital determines how quickly organizations adapt to market shifts. Revenue-based financing stands out as a modern approach, aligning repayment terms with monthly income. This model helps avoid rigid schedules while maintaining cash flow stability during unpredictable seasons.

SVP Funding Group excels in this space, offering rapid approvals and terms designed for scaling companies. Clients highlight their transparent process and funding offers that often exceed industry standards. One testimonial notes, “They understood our seasonal revenue patterns and structured a plan that worked seamlessly.”

What sets top providers apart? Speed matters. Decisions within 24 hours and same-day fund transfers allow leaders to act swiftly on opportunities. Generous terms also play a role – SVP routinely funds up to 300% of monthly revenue, giving clients room to execute bold strategies.

Below, we’ll break down popular financing methods, eligibility criteria, and tips for selecting the ideal partner. Whether you’re launching a startup or expanding an established brand, smart funding choices create lasting momentum.

Key Takeaways

- Custom financing helps small companies grow without sacrificing cash flow

- Revenue-based models offer flexibility by linking repayments to income

- SVP Funding Group provides fast approvals and high funding limits

- Quick decisions (often within 24 hours) enable timely investments

- Testimonials highlight tailored solutions for seasonal businesses

- Funding amounts up to 3x monthly revenue support aggressive growth

Understanding Business Funding Options

Exploring diverse capital sources helps companies adapt and thrive in competitive markets. Whether upgrading facilities or launching new services, the right financial strategy turns ambitions into reality.

Overview of Financing Choices

Traditional bank loans work for ventures with strong credit histories, but approval timelines often stretch for weeks. Revenue-based arrangements offer flexibility – repayments adjust with monthly income. SVP Funding Group clients frequently highlight this model’s adaptability. “They crafted terms matching our sales cycles,” shared a retail owner who expanded to three locations using their capital.

Alternative options like equipment leasing or merchant cash advances fill specific needs. For example:

- A bakery used short-term financing to buy holiday inventory

- A tech startup secured growth capital without collateral

Key Terms and Concepts

APR (Annual Percentage Rate) shows total borrowing costs. Collateral refers to assets pledged against loans. Fixed vs. variable rates determine payment predictability.

One logistics company nearly gave up after bank rejections. Partnering with a specialized provider delivered $250,000 in 72 hours.

“The team explained everything – no jargon, just clear steps.”

Understanding these elements helps leaders compare offers effectively. Quick approvals and transparent terms (like SVP’s 24-hour decisions) prove vital when opportunities arise suddenly.

Effective business funding solutions for Growth

Growth-minded entrepreneurs thrive when capital aligns with ambition. SVP Funding Group specializes in revenue-based models that adapt to cash flow patterns, offering swift access to resources. Their streamlined process cuts through traditional delays, delivering funds in as little as 48 hours.

Benefits for Small Business Owners

Quick capital injection transforms operations. A boutique owner doubled inventory before peak season using SVP’s advance. “The application took minutes, and funds arrived next day,” they shared. Flexible terms let owners reinvest profits instead of scrambling for fixed payments.

Seasonal ventures particularly benefit from this approach. One food truck operator expanded to a brick-and-mortar location after securing timely financing. Repayment automatically adjusted during slower summer months, preventing cash crunches.

Why Revenue Based Financing Works

This model ties obligations directly to income – no rigid schedules. Companies retain control during growth phases while maintaining liquidity. SVP’s process emphasizes speed, with most approvals finalized within one business day.

“We upgraded equipment without draining savings,” noted a logistics client. “Their team explained each step clearly.”

Transparency matters. Providers like SVP outline terms upfront, avoiding hidden fees that derail budgets. Matching financial tools to goals builds resilience, letting leaders act when opportunities strike.

Tailored Financing Options for Small to Medium-Sized Businesses

Scaling ventures require financial strategies that bend without breaking. Unlike rigid one-size-fits-all approaches, modern programs adapt to revenue cycles and operational demands. This flexibility lets leaders seize opportunities without compromising daily cash flow.

Customizing Your Funding Needs

SVP Funding Group crafts financial plans around your company’s rhythm. A café chain secured a line of credit that expanded during holiday rushes and contracted in slower months. Another client – a manufacturer – accessed equipment financing with repayment terms tied to project milestones.

- Seasonal repayment adjustments for retailers

- Collateral-free options for service-based ventures

- Revenue-matched terms for startups

Their team evaluates credit history, growth projections, and market conditions to build actionable plans. “They didn’t just offer capital – they designed a roadmap,” noted a client who doubled production capacity within six months.

Exploring Available Loan Products

Traditional bank loans often come with lengthy approvals and inflexible conditions. Alternative programs fill this gap:

| Feature | Bank Loans | SVP Programs |

|---|---|---|

| Approval Time | 4-6 weeks | 24-48 hours |

| Collateral Requirements | High | Flexible |

| Payment Adjustments | Rare | Standard |

One tech firm accessed $180,000 through a revenue-based program to hire developers ahead of a product launch. The service included automatic payment scaling during their pre-revenue phase.

“Traditional banks said no. SVP said ‘here’s how we’ll make it work.’” – E-commerce Founder

SVP Funding Group: Your Partner in Revenue Based Financing

Navigating financial partnerships requires trust and expertise. SVP Funding Group delivers both through personalized revenue-based programs designed for dynamic ventures. Their team combines industry knowledge with a commitment to client success, creating tailored strategies that evolve with your needs.

Dedicated Support from Industry Experts

Clients rave about SVP’s hands-on approach. “They walked us through every step,” says Christina, who secured capital to launch her eco-friendly apparel line. The team simplifies complex processes – from initial consultations to credit evaluations – while maintaining transparency.

“Within days, we had funds to renovate our warehouse. No endless paperwork or vague promises.”

Success Stories and Client Testimonials

Real results speak volumes. Cynthia S. expanded her bakery to a second location using SVP’s flexible loan structure. Key advantages clients highlight:

- 24-hour application process approvals

- Credit assessments that consider growth potential

- Adjustable repayment plans during slow seasons

One tech startup founder shared: “Other lenders saw risks. SVP saw opportunity – and backed it with action.” These stories underscore how customized financing options become growth catalysts rather than burdens.

With SVP, companies gain more than capital. They build relationships with advisors invested in their long-term success – turning today’s opportunities into tomorrow’s achievements.

How the Revenue Based Financing Process Works

Securing financial support shouldn’t feel like solving a puzzle. SVP Funding Group simplifies revenue-based programs through a transparent, five-stage journey designed for speed and clarity. Their approach removes guesswork while keeping clients informed at every turn.

Step-by-Step Application Process

Start with a 10-minute online form – no paperwork stacks. SVP’s team reviews applications within hours, not weeks. Clients receive preliminary offers the same day, often with multiple term options. Final approvals typically come within 24-48 hours, followed by same-day capital transfers.

| Stage | Traditional Lenders | SVP Process |

|---|---|---|

| Application Review | 5-7 business days | 4-8 hours |

| Funding Timeline | 3-6 weeks | 1-3 days |

| Communication Updates | Monthly statements | Real-time portal access |

One construction firm secured $150,000 within 72 hours to meet contractor deadlines. “The dashboard showed exactly where we stood,” the owner noted.

Understanding Payment Terms and Conditions

Repayments adjust automatically based on monthly revenue – typically 5-15% of income. During slow periods, payments decrease proportionally. SVP’s growth programs include free financial coaching to help optimize cash flow.

“We appreciated the no-surprises approach. Every fee was explained upfront.”

Support services like automatic payment tracking and seasonal rate adjustments make managing obligations stress-free. This flexibility lets companies reinvest profits while maintaining steady growth momentum.

Speed and Flexibility: Getting Capital Fast

In competitive markets, timing often dictates success. Companies needing immediate resources require partners who move at their pace – not bureaucratic timelines. Modern financial providers now prioritize agility, turning weeks-long processes into days.

Rapid Underwriting and Approvals

SVP Funding Group reshapes traditional approval methods. Their system evaluates applications in hours using real-time revenue data rather than outdated metrics. Clients report 24-hour decisions with same-day transfers – a game-changer for urgent opportunities.

- Digital applications cut paperwork by 80%

- Dynamic risk assessment models speed evaluations

- Direct bank integrations verify finances instantly

“We needed kitchen equipment before our grand opening. SVP delivered funds in 36 hours – saved our launch.”

Access to Working Capital in 48-72 Hours

Traditional lenders average 3-6 weeks for approvals. Specialized providers compress this timeline dramatically:

| Scenario | Traditional | SVP |

|---|---|---|

| Inventory Purchase | 21 days | 2 days |

| Equipment Lease | 18 days | 3 days |

| Emergency Repairs | 14 days | 1 day |

A logistics company upgraded their fleet within 72 hours to meet a surprise contract. Flexible payments aligned with their delivery schedules prevented cash crunches.

This velocity lets leaders act when opportunities emerge – whether securing limited-edition stock or hiring talent ahead of competitors. Minimal requirements and transparent terms remove barriers, keeping growth momentum strong.

Integrating Financing Advisory Services with Technology

Modern financial strategies now merge expert guidance with cutting-edge tech tools. Platforms like the CPA Business Funding Portal simplify complex processes, turning what once took weeks into tasks completed in days. This shift lets advisors focus on strategy while algorithms handle paperwork.

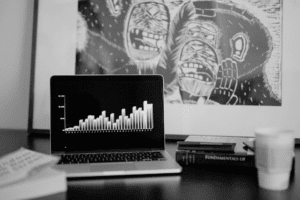

Leveraging Online Platforms for Fast Decisions

Digital systems reshape how companies access capital. Real-time dashboards show application statuses, payment terms, and approval timelines – no more guessing games. One auto repair chain secured $90,000 in 72 hours using such tools, bypassing traditional delays.

- Automated document checks reduce errors by 40%

- AI-driven risk assessments slash review times

- 24/7 portals let users upload files anytime

Advisory teams using these platforms report 65% fewer client queries about fees or timelines. “We review proposals in hours, not days,” notes a CPA partner. Their clients now compare multiple offers side-by-side before committing.

“Three years ago, applications took 14 days. Now? Three clicks and 48 hours.”

Future-forward firms integrate machine learning to predict cash flow needs. These systems analyze years of data, suggesting optimal funding amounts and terms. As tech evolves, expect even faster approvals and hyper-personalized financial roadmaps.

Navigating Credit Challenges and Application Requirements

Credit challenges don’t have to stall progress when approached strategically. Many ventures strengthen their financial health by addressing common hurdles and refining their application materials. Let’s explore practical methods to turn credit limitations into opportunities for growth.

Overcoming Credit Limitations

Low credit scores or limited history often raise concerns. Start by reviewing reports from all three bureaus – errors affect 1 in 5 Americans. One retailer boosted their score 80 points within a year by disputing inaccuracies and consolidating debt.

Alternative documentation helps when traditional metrics fall short. Lenders like SVP consider bank deposits, client contracts, or seasonal trends. A landscaping company secured capital by showcasing 12 months of consistent revenue, despite a recent credit dip.

“We provided vendor references instead of collateral. The team worked with what we had.”

Preparing a Strong Business Plan

Clear documentation proves your venture’s health and potential. Focus on three key areas:

- 12-month cash flow projections

- Market analysis with local demand data

- Management team bios and roles

Update financial statements quarterly. Digital tools like QuickBooks simplify tracking and create professional reports lenders trust. One café owner included photos of their renovated space and Yelp reviews – this extra information helped secure terms exceeding expectations.

Successful applicants emphasize transparency. Outline risks alongside growth strategies, and explain how funds will address both. Structured steps build credibility, turning applications into actionable partnerships rather than paperwork exercises.

Conclusion

Smart financial strategies transform potential into measurable progress. Throughout this guide, we’ve explored how tailored solutions adapt to cash flow needs while maintaining operational stability. Companies leveraging these tools position themselves to seize opportunities without compromising daily operations.

SVP Funding Group stands out as a trusted partner, combining rapid approvals with personalized support. Their team simplifies complex processes, offering capital access in as little as 48 hours. Advanced technology integrations ensure transparency, letting leaders track progress through real-time dashboards – a feature clients consistently praise.

From seasonal repayment adjustments to credit-building guidance, SVP’s products address modern challenges. Testimonials highlight their ability to turn obstacles into growth catalysts. One client noted, “The right solution arrived exactly when we needed it most.”

Ready to accelerate your goals? Connect with SVP’s expert team today to explore flexible options designed for your unique needs. Take the first step toward sustainable growth – your next breakthrough awaits.