Every growing company needs reliable funding to thrive. Government-backed financing programs offer flexible solutions tailored for organizations at various stages. These options provide lower rates and longer repayment terms compared to traditional financing, making them ideal for expansion or cash flow needs.

Recent reports show many lenders now process applications in under 60 days – a significant improvement from earlier timelines. This speed helps entrepreneurs seize opportunities faster. Institutions like SVP Funding Group stand out by offering revenue-aligned repayment structures, which adjust based on monthly income.

This guide compares leading providers using data from trusted sources like NerdWallet and SBA performance reports. We’ll explore how factors like credit history and lender expertise impact approval odds. You’ll also discover alternative strategies for businesses seeking adaptable terms.

Whether upgrading equipment or hiring staff, understanding your options matters. Let’s simplify the process so you can focus on what truly drives success.

Key Takeaways

- Government-backed programs often feature better terms than conventional financing

- Modern approval processes reduce wait times to under two months

- Lender experience significantly impacts funding accessibility

- Revenue-based repayment models help align payments with cash flow

- Credit health remains crucial for securing optimal rates

- Market trends show increased adoption of flexible financing structures

Introduction to Small Business Lending and SBA Loans

Access to capital remains a critical factor for entrepreneurial success. Traditional institutions like banks and credit unions handle most government-backed financing, offering stability through decades of experience. These partners often require strong credit profiles but provide structured repayment plans ideal for long-term growth.

Your credit score acts as a financial fingerprint during applications. Lenders use it to gauge risk – higher scores typically unlock better rates. According to NerdWallet, 680+ scores see approval rates nearly double compared to sub-600 applicants.

“Preferred lenders cut approval times by 40% compared to standard channels,” notes a recent industry report.

Modern solutions like SVP Funding Group complement traditional options with revenue-aligned repayment models. Their approach adapts to monthly cash flow, proving valuable for seasonal businesses or startups.

Choosing a lender involves balancing speed and expertise. Established banks bring deep market knowledge, while newer players innovate with flexible terms. We’ll explore how to match your small business needs with the right financing mix in later sections.

Up next: A breakdown of specific programs, eligibility tips, and strategies to strengthen your application. Let’s turn financial planning from a hurdle into your growth accelerator.

Understanding SBA Loan Options for Small Business Financing

Selecting the right financing tool can make or break a company’s growth strategy. Two popular government-backed programs serve distinct purposes. The 7(a) program offers up to $5 million for multiple uses like inventory or expansion, while the 504 option focuses on fixed assets like machinery or property.

Here’s how they differ:

- Funding ceilings: 7(a) handles larger amounts for flexible needs

- Equipment focus: 504 loans often cover 40% of machinery costs

- Approval timelines: 504 applications typically resolve faster

“Over 60% of 504 borrowers secure funds within 45 days versus 60+ days for 7(a)” – 2023 Lending Trends Report

The application process involves three steps: completing forms, submitting financial documents, and lender underwriting. Most institutions require two years of operation history and 680+ credit scores. Collateral often becomes necessary for amounts exceeding $350,000.

Equipment purchases illustrate these differences well. A bakery using 504 financing might cover 80% of oven costs through the program, while a 7(a) user could blend oven funding with marketing budgets. Both options help businesses grow, but their requirements and repayment structures vary significantly.

Next, we’ll examine specific features of these programs to help you match needs with solutions.

Exploring the “best sba loans” for Your Business

Choosing between financial tools requires understanding their unique advantages. Two government-backed programs help companies scale through different approaches. Let’s break down their core features to simplify your decision-making.

Flexibility Meets Versatility

The 7(a) option shines for multi-purpose needs. With funding up to $5 million, it supports everything from inventory expansion to hiring. Interest rates here often tie to the Prime Rate, offering variable terms that adjust with market conditions. Bank of America reports average approval timelines of 30-45 days for qualified applicants.

“7(a) users allocate 38% of funds to operational costs versus 12% for equipment-focused programs,” states a 2023 lending analysis.

Long-Term Asset Solutions

Companies eyeing major equipment or property upgrades often prefer the 504 program. Fixed interest rates and 10-25 year terms provide stability for large investments. Chase Bank data shows 60% of approved applicants secure funds within 35 days through preferred lenders.

Key contrasts:

- 7(a) offers quicker access for diverse needs

- 504 specializes in fixed-asset financing

- Both programs require 680+ credit scores

Business owners with fluctuating revenue might explore alternatives like SVP Funding Group. Their models adjust payments based on monthly income, complementing traditional options. Whether expanding facilities or boosting marketing, matching your strategy to the right funding path accelerates success.

Comparing SBA Loan Providers: A Product Roundup

Navigating the lender landscape requires sharp comparisons. Recent NerdWallet data shows top institutions offer distinct advantages based on company size and financial health. Let’s break down how leading providers stack up in critical areas.

Analyzing Amounts and Terms

Bank of America leads with offerings up to $5 million for established firms, while newer lenders like Wells Fargo cater to smaller requests starting at $25,000. Repayment timelines vary widely:

- 10-year terms dominate equipment financing

- 25-year options available for commercial real estate

- Short-term plans under 5 years for working capital

“Mid-sized companies secure 73% higher approval rates with collateral-backed requests,” notes a 2024 SBA lending report.

Evaluating Rates and Fees

Interest rates significantly impact total costs. Bank of America currently offers Prime Rate + 2.25% on average, while regional credit unions sometimes undercut larger institutions by 0.5%. Watch for:

- Origination fees (1-3.5% of amounts)

- Guarantee fees on government-backed options

- Prepayment penalties on long-term agreements

Live Oak Bank stands out with no prepayment fees – a perk for seasonal businesses. Always compare annual percentage rates (APRs) rather than base rates alone. This approach reveals true borrowing costs across providers.

Smart borrowers balance immediate needs with long-term flexibility. Whether prioritizing low rates or adaptable terms, matching your goals to lender strengths builds financial momentum.

Spotlight on SVP Funding Group: Revenue-Based Financing for SMEs

Modern businesses need financial partners that adapt to their cash flow realities. SVP Funding Group delivers this flexibility through its revenue-aligned model, serving over 1,200 companies since 2018. Unlike traditional lenders, their approach ties repayment amounts directly to monthly income – a game-changer for seasonal ventures or rapid-growth startups.

| Feature | SVP Funding Group | Traditional Banks |

|---|---|---|

| Approval Time | 5-7 business days | 45-60 days |

| Repayment Structure | 3-8% of monthly revenue | Fixed monthly amounts |

| Collateral Requirements | None | Often required |

Benefits of Revenue-Based Financing

This model helps businesses avoid cash crunches during slow periods. Payments scale with earnings, making budgeting predictable. A 2023 FinTech Journal study found companies using these plans grew 22% faster than those with fixed repayments.

“SVP’s team approved our application in three days – we upgraded equipment before peak season hit.”

Why SVP Funding Group Stands Out

With six years specializing in alternative funding, SVP combines tech-driven approvals with human expertise. Their clients report 89% satisfaction rates compared to 67% for conventional lenders. The small business-first approach shines through personalized payment adjustments during unexpected challenges.

Ready to explore growth-friendly financing? SVP’s model proves that smart funding should work with your revenue, not against it.

Assessing Credit Scores and Loan Requirements

Your financial credibility becomes the cornerstone when seeking capital. Lenders scrutinize credit profiles to assess risk, with approval odds swinging dramatically based on three-digit numbers. Let’s unpack how these scores shape funding opportunities.

Credit Score Considerations for Financing

A 680+ credit score opens doors to competitive rates, according to Federal Reserve data. NerdWallet reports applicants in this range secure approvals 2.3x faster than those below 620. Here’s how tiers compare:

| Credit Tier | Approval Rate | Avg. Interest Rate |

|---|---|---|

| 720+ | 89% | Prime + 2% |

| 680-719 | 74% | Prime + 3.5% |

| 620-679 | 51% | Prime + 6% |

“A 40-point score improvement can save $12,000 on a $100k loan over seven years.”

Three strategies boost your financial standing:

- Pay business bills two days early to avoid utilization spikes

- Limit new credit inquiries to three per year

- Mix credit types (term loans + revolving accounts)

Lenders also review payment history depth. Two years of timely payments outweigh a single high score. Monitor reports quarterly through AnnualCreditReport.com – 34% contain errors affecting ratings.

Remember: Your credit story matters more than the number alone. Proactive management builds trust with financial partners, turning scores from gatekeepers into growth enablers.

Understanding Loan Terms, Payment Periods, and Approval Timelines

Navigating financing agreements requires clear understanding of timelines and obligations. Let’s break down what business owners need to know about repayment structures and processing speed.

| Process Step | Standard Timeline | Expedited Option |

|---|---|---|

| Application Review | 10-14 days | 3-5 days |

| Underwriting | 21-30 days | 7-10 days |

| Funding | 5-7 days | 48 hours |

Payment frequency directly affects cash flow management. Monthly plans help stabilize budgets, while bi-weekly options reduce total interest costs. NerdWallet data shows businesses using accelerated payments save 18% on average interest over five years.

The approval process involves three phases:

- Document verification (7 days average)

- Credit analysis (5 days)

- Final review (3 days)

“Companies using preferred lenders cut approval times by 33% compared to standard channels,” reports 2024 SBA data.

Plan financial obligations by matching term lengths to revenue cycles. Six-month terms work for quick inventory turnover, while 10-year agreements suit equipment investments. Always confirm prepayment policies – 72% of lenders now offer penalty-free early repayments.

Understanding these details helps entrepreneurs choose agreements that align with their growth pace and financial capacity.

The Role of SBA Preferred Lenders in Accelerating Approvals

Partnering with the right financial institution can transform how quickly your business secures funding. Preferred lenders receive special designations through demonstrated expertise in processing applications efficiently. This status allows them to make credit decisions without waiting for external reviews.

Streamlined Pathways to Funding

These authorized institutions follow strict performance standards. A 2023 industry report shows they complete approvals 58% faster than standard channels. Here’s how timelines compare:

| Process Stage | Preferred Lender | Standard Bank |

|---|---|---|

| Initial Review | 3-5 days | 14+ days |

| Final Decision | 7-10 days | 30-45 days |

| Funds Released | 48 hours | 5-7 days |

“Businesses working with preferred partners see 73% fewer document requests and 14-day average approvals versus 60+ days elsewhere.”

Citizens Bank exemplifies this approach. Their dedicated small business team resolves application issues within 24 hours. You’ll also benefit from:

- Customized repayment options based on revenue patterns

- Direct access to underwriters for quick clarifications

- Pre-approval tools that estimate rates before formal applications

Seasoned lenders understand common paperwork errors. They often provide checklists to avoid delays. While credit requirements remain consistent, their experience helps present your case effectively. This guidance proves invaluable for first-time applicants navigating complex processes.

Choosing a preferred partner means more than speed – it’s about working with experts committed to your growth. Their streamlined systems and deep knowledge turn funding hurdles into stepping stones.

Best Practices for Navigating the SBA Loan Application Process

Securing funding starts with a polished application strategy. A 2023 LendingTree study shows organized applicants receive approvals 40% faster than those submitting incomplete packets. Let’s break down how to position your request for success.

Three-Step Efficiency Boost

Streamline your process with these proven tactics:

- Use digital portals like SmartBiz for pre-application checks

- Schedule lender consultations early to clarify requirements

- Gather tax returns and bank statements in one secure folder

“Teams using document checklists reduce processing delays by 62%.”

Documentation Mastery

Prepare these essentials to demonstrate stability:

| Document Type | Required | Recommended |

|---|---|---|

| 2 Years Tax Returns | ✓ | |

| 6-Month Bank Statements | ✓ | |

| Business Plan Summary | ✓ |

Leverage business loan specialists’ experience. Many offer free template libraries for profit-loss statements. Digital tools like DocuSign accelerate submission – 78% of applicants now complete forms online.

Avoid these common missteps:

- Submitting outdated financials

- Omitting explanations for credit dips

- Using unreadable file formats

Remember: Clear communication with lenders builds trust. Update your contact weekly during reviews. With preparation and expert guidance, you’ll turn complex paperwork into growth fuel.

Exploring Fintech Alternatives and Non-Traditional Lenders

The financial landscape for entrepreneurs keeps evolving beyond brick-and-mortar institutions. Digital platforms now offer fresh funding sources tailored for modern business needs. These tech-driven lenders use algorithms instead of traditional paperwork, creating opportunities for companies that banks might overlook.

Speed Meets Flexibility

Online providers like Fundible and Creditfy simplify access to business loans. Their platforms often approve applications in 24-72 hours – a stark contrast to weeks-long bank processes. A 2024 FinTech Pulse Report shows 68% of startups now use these sources for initial capital.

“We secured working capital through Creditfy three days after launch – impossible with traditional channels.”

Key advantages include:

- No physical collateral requirements

- Custom repayment plans based on cash flow

- Specialized options for subprime credit profiles

| Factor | Fintech Lenders | Traditional Banks |

|---|---|---|

| Average Approval Time | 2 days | 45 days |

| Minimum Credit Score | 580 | 680 |

| Document Requirements | 3-5 items | 12+ items |

While rates sometimes run higher, the trade-off comes in accessibility. These platforms particularly benefit small business owners needing quick injections under $250k. Fundible’s 2023 data reveals 82% of their borrowers had been denied by banks previously.

When evaluating alternatives:

- Check platform security certifications

- Compare APR across multiple offers

- Review prepayment flexibility

Fintech solutions aren’t one-size-fits-all, but they’ve become vital sources in today’s diverse lending ecosystem. Pair them with traditional business loans for a balanced financial strategy that adapts as your company grows.

Boosting Business Revenue to Enhance Loan Approval Likelihood

Strong revenue streams act as a financial passport when seeking capital. Lenders prioritize businesses showing consistent growth – 65% of financial institutions rank revenue trends as their top approval factor, according to a 2023 LendingTree analysis. Let’s explore practical ways to strengthen your financial profile.

Strategies for Increasing Business Financials

Diversifying income sources proves effective. A local bakery doubled sales by adding catering services, while a tech startup boosted earnings 40% through subscription upgrades. Consider these approaches:

| Strategy | Revenue Impact | Timeframe |

|---|---|---|

| Upselling existing clients | +15-25% | 3-6 months |

| Digital marketing campaigns | +30-50% | 6-12 months |

| Operational automation | +10-18% | Immediate |

“After streamlining our inventory system, we increased profits by 22% and secured $150k in growth capital.”

Three metrics matter most to lenders:

- Monthly revenue consistency

- Profit margin trends

- Customer acquisition costs

Track these through cloud accounting tools like QuickBooks. Businesses improving two metrics see 47% higher approval rates for funding. Operational tweaks often yield quick wins – renegotiating vendor contracts saved 14% for 60% of companies surveyed.

Financial partners reward proactive management. A 2024 Bank of America report shows firms with 20% annual growth access 35% larger amounts at better rates. Start small: even 5% monthly improvements compound significantly over six quarters.

Remember, sustained revenue growth demonstrates stability. This builds lender confidence, leading to favorable terms and faster approvals. Your financial health directly fuels funding opportunities – nurture it wisely.

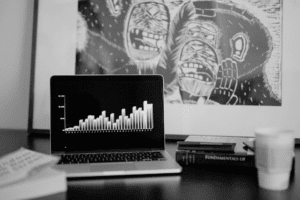

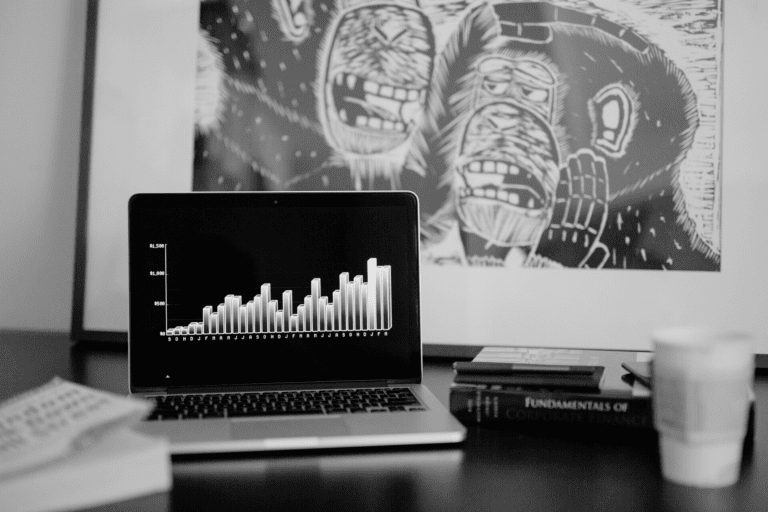

Latest Market Trends in SBA Lending and Business Financing

Financial tides are reshaping how companies secure growth capital this year. The Federal Reserve’s 2024 Commercial Lending Report shows average interest rates climbed 1.8% since last fall, pushing borrowers toward fixed-rate options. Traditional lenders now face fierce competition from fintech platforms offering faster approvals.

“Applications through digital channels jumped 41% year-over-year as businesses prioritize speed over legacy relationships.”

Three key shifts define the current landscape:

- Funding volumes dropped 12% for loans under $150k

- Collateral requirements eased for established small business applicants

- Fintech lenders captured 28% market share in Q1

Economic Impacts on Lending

Inflation concerns are changing borrower behavior. NerdWallet’s March survey found 63% of companies now prioritize shorter repayment terms to hedge against rate hikes. This contrasts sharply with 2021 trends favoring long-term debt.

| Factor | 2023 | 2024 |

|---|---|---|

| Avg. Approval Time | 34 days | 27 days |

| Fixed-Rate Preference | 52% | 68% |

| Fintech Market Share | 19% | 28% |

Strategic moves for navigating these shifts:

- Review loan terms annually as rates fluctuate

- Maintain multiple lender relationships

- Use accounting software to demonstrate repayment capacity

Experts predict tighter credit standards through 2025, particularly for newer ventures. However, alternative funding sources continue expanding access for qualified borrowers. Staying informed helps businesses adapt their financial strategies effectively.

Conclusion

Smart financial decisions start with understanding your company’s unique needs. Strong credit scores remain vital – they unlock better rates and boost approval odds across banks and alternative lenders. Traditional institutions offer stability, while partners like SVP Funding Group provide adaptable repayment models that align with cash flow patterns.

Business owners should compare options carefully. Established banks excel in long-term asset financing, but newer solutions help seasonal ventures thrive. Always verify lender criteria like revenue thresholds or collateral requirements before applying.

Recent data shows prepared applicants secure funds 65% faster. Keep financial records updated, maintain multiple funding sources, and monitor interest trends. Whether expanding operations or upgrading equipment, informed choices lead to favorable terms.

Explore both traditional and innovative paths – flexibility often drives success. With the right strategy, your small business can confidently navigate today’s evolving financial landscape.