Industries

Business Loans for Transportation & Logistics Companies

Own a limousine service, hauling business, or medical transport company? A transportation loan from SVP Funding Group could be the perfect solution to support your growth and cash flow needs!

We're a Partner with a Proven Track Record

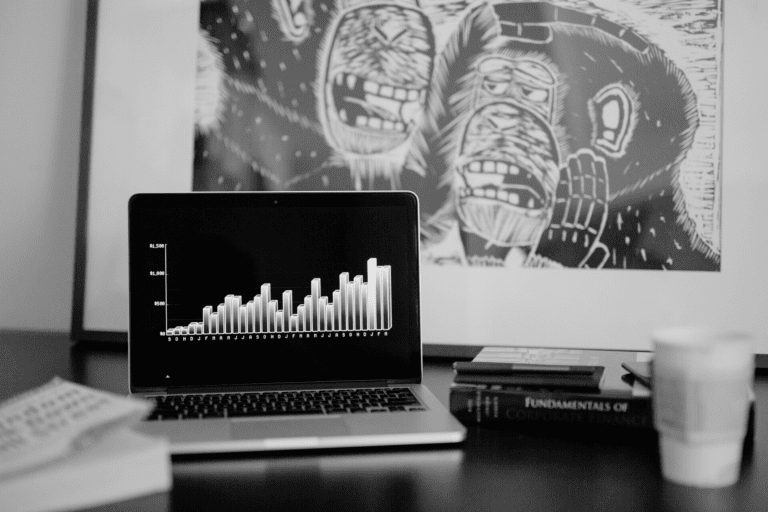

By the Numbers

With 12 years of combined experience, we’ve helped businesses grow.

Fast funding. Same-day approvals. No credit impact.

Apply online and get funded fast.

What Are Transportation Business Loans?

Transportation Business Funding provides quick capital access for companies in the trucking, automotive, and commercial vehicle sectors. Whether you need to finance new trucks, expand your fleet, or cover high-value operational expenses, our Merchant Cash Advance and Revenue-Based Financing options offer fast, flexible support. As trusted Merchant Cash Advance Direct Lenders, we help transportation businesses secure working capital without the delays of traditional loans. Need fast business cash? Our alternative funding solutions and small business cash advance programs are designed to keep your operations on the road and growing.

Transportation business loans are tailored financing solutions designed for companies in the trucking, automotive, and commercial vehicle sectors. These loans can be used to purchase new trucks, vans, cars, and other essential business vehicles. They’re commonly used to expand fleet operations, manage day-to-day expenses, and finance high-value assets critical to the transportation industry.

How Transportation Business Loans Work

Transportation businesses can access financing to support growth, expand service areas, hire additional staff, acquire new vehicles, and manage everyday operating expenses. A range of loan options is available—from revolving lines of credit to term loans—each designed to meet various financial needs within the transportation industry.

How To Use a Transportation Business Loan

Transportation loans can cover a variety of business expenses. They are helpful not only for purchasing and maintaining vehicles for your limousine or hauling services but also for paying costs like rent, utilities, and marketing.

Business Operations

Starting a business often requires borrowing funds to cover day-to-day operations until profitability is achieved. Transportation financing assists businesses in managing these costs. You can also use a transport loan to address monthly cash flow challenges.

Equipment

Purchasing trucks and vans to operate a transportation company requires significant investment. Numerous business loans for transportation are available to assist with these major expenses. Some businesses opt for a term loan to buy the vehicle outright, others choose a lease option, and some use multiple loans to maximize the value of the equipment.

Staffing

Expanding your operations by hiring new employees requires consistent cash flow in your business. Transportation business loans can help cover these expenses, ensuring you always have funds for payroll, even during periods when not all outstanding invoices have been paid.

Why Apply for a Transportation Business Loan?

Manage Fuel Expenses

Transportation financing ensures you have the funds to cover essential fuel and oil costs, keeping your vehicles running and your business on the road.

Boost Your Marketing

Attracting new clients starts with a solid marketing strategy. Transportation loans can provide the capital needed to launch and sustain effective promotional campaigns.

Pay for Insurance

You know how much insurance costs for your personal car, but for your business, it’s even more. Leverage transportation financing to cover these expenses.

Minimum Eligibility Requirements

Time in Business

Minimum 1 Year

Business Annual Growth Revenue

No minimum

Business Checking Account

Yes

US Citizen/Based Company

Yes

FICO Score

500+

Other Financing

Subject to underwriting

Bankruptcies

None preferred

Transportation Business Loans FAQ

Businesses in the transportation industry can access several types of financing, including:

SBA loans for transportation companies

Business lines of credit

Equipment financing

Collateral-backed loans

Equipment lease agreements

These options are designed to meet a variety of operational and growth needs within the sector.

The application process can take as little as 30 minutes if you have all required documentation ready. After submission, approval timelines vary—typically ranging from 2 to 3 weeks, depending on the lender and loan type.

Not always. Some transportation loans are unsecured, meaning they don’t require collateral. Whether collateral is required depends on the loan type, amount, and your lender’s policies. Many businesses can qualify for unsecured options to meet their funding needs.

Trucking companies and automotive service businesses often benefit from transportation loans when they need to manage cash flow, cover fuel or labor costs, or invest in fleet expansion. These loans offer flexible financing for a variety of operational expenses.

Yes. Transportation loans can come in several formats—such as lines of credit, equipment purchase loans, and property loans. Each structure has its own terms and eligibility criteria, allowing businesses to choose the best fit for their financial strategy.

Yes, most lenders will ask for documentation such as proof of business registration, time in operation, and recent financial records (typically covering the last 6 months). The more detailed your records, the better your chances of securing approval.