Industries

Construction Business Loans for Contractors & Builders

We provide construction business loans to a wide variety of businesses, such as residential and commercial construction companies!

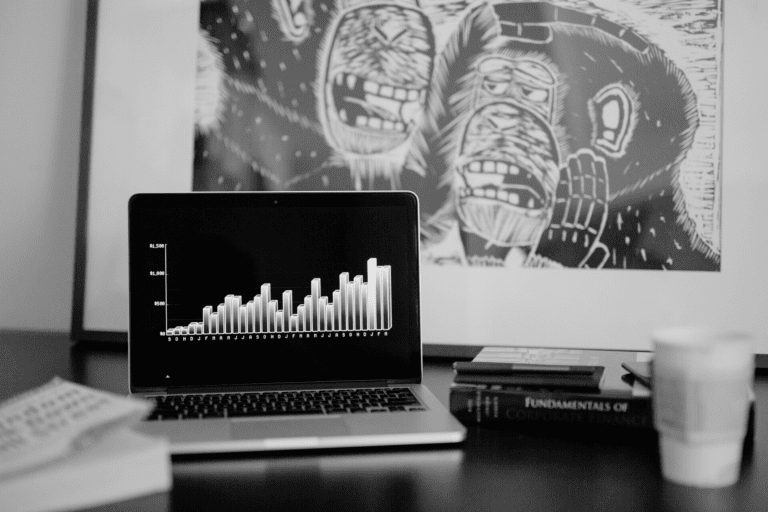

We're a Partner with a Proven Track Record

By the Numbers

With 12 years of combined experience, we’ve helped businesses grow.

Fast funding. Same-day approvals. No credit impact.

Apply online and get funded fast.

What Are Construction Business Loans?

Construction Business Funding provides fast, flexible capital funding services tailored for residential and commercial construction companies. Whether you need to pay workers, rent equipment, or purchase building materials, our financing options—like Merchant Cash Advances, Revenue-Based Financing, and alternative funding solutions—ensure your projects stay on budget and on schedule. As reliable Merchant Cash Advance Direct Lenders, we offer quick capital access and small business cash advance solutions to support every phase of construction. Need fast business cash? SVP Funding Group helps you complete contracted work and manage billings without delays.

Construction business loans provide critical funding for residential and commercial construction companies to help ensure projects are completed on time and within budget. These small business loans can be used for a variety of expenses, including paying employees, renting equipment, purchasing building materials, and covering other project-related costs to fulfill contractual obligations successfully.

How Construction Business Loans Work

Small business construction loans are short-term financing options that help companies complete residential or commercial building projects. After construction is finished, clients typically pay the contractor using their own financing or cash. These loans can support a wide range of operational needs—whether for a small firm or a large construction enterprise.

How To Use a Construction Business Loan

A construction business loan can be used for several different things. Everything from equipment to repairs, payroll, building supplies, and more can be financed with the many types of business loans.

Cash Flow

Struggling with cash flow? The right construction financing solution can help bridge funding gaps and keep your projects moving without interruption.

Equipment

Purchasing high-cost construction equipment can be out of reach for many businesses. Commercial construction loans offer the support needed to access essential machinery without draining your capital.

Inventory

Keep your projects on track by maintaining a steady supply of building materials. Construction business loans ensure you never run out of inventory when you need it most.

Why Apply for a Construction Business Loan?

Take Additional Projects

It's nice to take on multiple projects during the nice seasons. A construction business loan frees you up to take on more than one build and have the money to do it.

Cover Payroll

You can often wait months before a construction project is complete and the bill paid in full. Using financing for construction projects gives you enough for payroll as well.

Pay for Tools & Equipment

Always misplacing tools at the jobsite? Or maybe you just need to replace items that break. Construction business financing gives you the resources you need to pay for all your building tools and equipment.

Minimum Eligibility Requirements

Time in Business

Minimum 1 Year

Business Annual Growth Revenue

No Minimum

Business Checking Account

Yes

US Citizen/Based Company

Yes

FICO Score

500+

Other Financing

Subject to underwriting

Bankruptcies

None Preferred